Catching Up to the 'Big Four': China's Robotics Industry Forges Ahead

Published Time:

Jul 04,2018

From handling, palletizing, and welding in production activities, to reading newspapers and providing companionship in daily life, and even to mine clearance and combat in military operations, the "robot age" is dawning. Robots are advanced automated equipment in modern manufacturing that integrate multiple disciplines such as mechanics, electronics, control, computers, sensors, and artificial intelligence. According to their application fields, they are classified into industrial robots, service robots, and special robots.

From handling, palletizing, and welding in production activities, to reading newspapers and providing companionship in daily life, and even to mine clearance and combat in military operations, “ robots era ”is approaching.

Robots are important automated equipment in modern manufacturing that integrate advanced technologies from multiple disciplines, including mechanics, electronics, control, computers, sensors, and artificial intelligence. According to their application fields, they are divided into industrial robots 、 service robots and special robots 。 International Federation of Robotics ( IFR) data shows that in 2017, the global robot market reached $23.2 billion, with the industrial robot market being the largest at $14.7 billion, special robots second at $5.6 billion, and service robots at $2.9 billion. Since 2009, the annual global sales of industrial robots have increased year by year. Driven by the rising domestic labor costs and the demand for "robot replacement," the Chinese industrial robot market began to develop rapidly in 2013. In the same year, China surpassed Japan to become the country with the largest annual robot purchases, and has remained the world's largest application market to this day. 2015 was also considered the "first year of robots in China" by the industry. In May 2015, the Made in China 2025 ” plan was implemented, clearly listing industrial robots as one of the ten key areas to be vigorously promoted and developed, promoting the standardization and modularization of robots, and expanding market applications.

“In 2015, the industry experienced explosive growth,” Zhu Sendi said. “The market share of domestic robots in the domestic market increased from 26% in 2013 to 33% in 2016, giving domestic robots a share of the market. In 2016, the four major families accounted for over 60%.” In his view, 2015-2025 will be a period of rapid growth for China's robot industry, but before 2035, China's robot industry will still be in a period of catching up.

1

“Bottleneck” problems

“In the field of industrial robots, core components are heavily reliant on imports, creating a ‘bottleneck’ for the development of domestic robots,” said Qu Xianming, member of the National Strategy Advisory Committee for Manufacturing Power and director of the Manufacturing Research Office of the Chinese Academy of Engineering. Industrial robots are mechanical bodies , control systems, drive and transmission systems, and sensor components, and the upstream industry produces reducers , servo systems, controllers , three core components. Midstream companies are robot body manufacturers, and downstream companies are system integrators. Since the three core components of industrial robots account for more than 70% of the robot's cost, the long-term lag in the development of core components has hindered the development of China's industrial robot industry. Taking precision reducers, which are used to precisely control robot movements and transmit greater torque, as an example, currently more than 70% of the global precision reducer market is occupied by two Japanese companies, Harmonic Drive Systems and Nabtesco, and China also mainly relies on imports. However, data from the Partner Industry Research Institute shows that since 2016, with the increase in the output of domestic precision reducers, China's imports of precision reducers have begun to decline. At the same time, in the domestic RV reducer (used in robot joints over 20 kg) field, Nantong Zhenkang Machinery Co., Ltd. (hereinafter referred to as Nantong Zhenkang) sold 28,000 units in 2017; Qin Chuan Machine Tool Group also achieved sales of nearly 10,000 units last year. Both companies are also building digital workshops, which will increase production capacity by 60,000 units respectively.

In a research report on the process of industrial robot localization, Zhongtai Securities Research Institute analyzed that domestic companies have achieved independent research and development and market promotion in some servo motors , controllers and other core components. Currently, robot reducers market is highly monopolized, and during the popularization period, domestic reducers cannot achieve complete import substitution. Qu Xianming believes that there are three difficulties in the complete import substitution of domestic reducers. First, China's “specialized, refined, and characteristic” enterprise groups engaged in the research and development and production of core components have not yet emerged; second, users are more tolerant of foreign components and more demanding of domestic ones; and third, the industry's focus on mainframes over components has not yet been completely reversed. Controllers, used to issue and transmit motion instructions, are considered the “brain” of the robot, and this is also the core component with the smallest gap between domestic and foreign products. Zhongtai Securities' research report states that controllers include hardware and software components. The hardware is the industrial control board card, which is currently mastered by domestic brands; the software part mainly includes control algorithms, secondary development, etc., and domestic brands still have gaps in stability, response speed, and ease of use. Compared controllers to this, China is completely at a disadvantage in servo systems, with the market almost monopolized by Japanese companies represented by Yaskawa and German companies represented by Siemens, with a domestic rate of only 10%, including domestic manufacturers such as Estun and Guangzhou CNC.

Servo systems are industrial robots the main power source, consisting of servo motors , servo drivers and encoders. The cost of the servo system alone accounts for robots 23% of the industrial body cost. A research report by the Partner Industry Research Institute points out that the gap between domestic and foreign servo systems mainly lies in the lack of high-power products, the lack of sophistication in miniaturized products, and the lack of high-precision encoders. In January 2018, China released the “ Made in China 2025 The "Green Book on Technological Innovation in Key Areas-Technology Roadmap (2017)" proposes that by 2020, domestically produced robots and key components with independent intellectual property rights will meet 50% of the domestic market's supply capacity.

Incremental Market Opportunities

Domestic robot products are mainly in the mid-to-downstream sectors. For robot body manufacturers in the midstream, their products can only generate sales and profits when ultimately applied downstream. Industrial robots in China are widely used in the automotive, electronics, and metal processing industries. Currently, the largest application scales are concentrated in the automotive and electronics industries. In 2016, the two sectors accounted for a combined 72% share, with the automotive industry accounting for 43%. In the automotive field, the "Big Four" have occupied most of the market. Li Zexiang, director of the Automation Technology Center at the Hong Kong University of Science and Technology, said: "I have always urged people not to compete head-on with the 'Big Four' in the automotive industry because there is no opportunity. We should shift to industries with Chinese characteristics, industries where giants have not yet ventured." In fact, the "Big Four" each have their own focus. Fanuc mainly relies on controllers to enter the market, and its robot and other businesses are all expanded around its core CNC control system. Yaskawa uses its servo system to enter the market, and this part of the revenue has consistently exceeded its robot body business. In contrast to the two Japanese companies are ABB and KUKA. The two are less involved in upstream core components, instead focusing on downstream system integration and application businesses. Luoshi (Beijing) Technology Co., Ltd. (hereinafter referred to as Luoshi Robotics), a Chinese startup company that started by developing a control system suitable for small six-axis robots and provides both robot bodies and intelligent manufacturing solutions, chose to avoid the leading market of the "Big Four" and target emerging incremental markets such as sewing.

"Typically, a robot product can only cover a limited number of industry scenarios, but China is a manufacturing powerhouse with many unique industry application scenarios, which also gives Luoshi potential opportunities." said Tuo Hua, CEO of Luoshi Robotics. Liu Jinzhang, project director of the High-Tech Center of the Ministry of Science and Technology, believes that with the increasing capacity and demand in China and globally, robot market on the one hand, Chinese companies are striving to make robots usable, durable, and easy to use; on the other hand, the production capacity and quality of domestic robots are also improving, allowing them to gain market share in emerging markets. Zhu Sende believes that domestic robots should also enter the automotive field. "Domestic robots are basically used in scenarios with high labor intensity and harsh environments. We should enter the automotive field from alleviating some heavy manual labor." he said.

Zhu Sende provided a path for entering the automotive industry. In his view, if it is not possible to directly enter the domestic automotive industry, it can be exported and then sold domestically, first obtaining orders from abroad before entering the domestic market. However, the prerequisite for this step is to improve the reliability of the robots and ensure the normal operation of the production line.

Cultivating Leading and Small Giant Enterprises

"China needs leading enterprises in the robotics industry." said Chu Jianhua when asked about the problems that still need to be solved in China's robotics industry. In his view, the robotics industry is not only a technology-intensive industry that requires continuous technological innovation; at the same time, the robotics industry also has economies of scale, and the competitiveness of leading enterprises to a certain extent determines the competitiveness of the robotics industry. "In terms of procurement of components, the bargaining power of leading enterprises can promote the reduction of robot costs," said Liu Jinzhang. "With leading enterprises, China can compete head-on with international giants." Affiliated with the Chinese Academy of Sciences, Siasun Robot Automation Co., Ltd. ( 300023.SZ, hereinafter referred to as Siasun) is a full-industry-chain robot enterprise that is among the top 10 core leading enterprises in China's robotics industry. Chen Li, director of the Hangzhou Siasun Robotics Research Institute, told Jiemian News that industrial robots are the most important equipment for constructing intelligent manufacturing systems. Without industrial robots, an intelligent manufacturing system cannot be constructed. Leading enterprises in the industry are the core force behind robots, artificial intelligence, and intelligent manufacturing. According to Chen Li, Siasun is currently focusing on the research and development and manufacturing of robot bodies, while also focusing on the research and development of robot offline simulation software, "This is what international giants such as Siemens are currently doing, and it is also an area that China hopes to break through. Not all domestic robot companies have simulation software." Qu Xianming also pointed out that China should learn from the lessons of the lagging development of chips and dependence on others, and grasp the core component technology of robots in its own hands. His suggestion is to cultivate a large number of "specialized, refined, and characteristic" small giant enterprises to provide supporting services for robot manufacturers and ultimately move towards becoming "world hidden champions."

BLOGS

Nobot Group's 2025 Kick-off Event: A Team Building Activity Focused on Unity and Power

This opening ceremony was both a knowledge-boosting session, allowing employees to continuously grow through learning, and a team-building event, bringing everyone closer together. It impressed upon each employee that in today's increasingly competitive market, only by continuously learning new knowledge, daring to innovate, and maintaining teamwork can we remain undefeated. With the collective efforts of all employees, Nobot will surely ride the waves and achieve even greater success on this new journey, steadily advancing towards higher goals!

Nobot was invited to attend the Belt and Road International Exchange Conference

On July 28, 2024, the 2024 Liaocheng "Belt and Road" International Exchange Conference and the Unveiling Ceremony of the Central Asia International High-end Talent Joint Training Base were held in the Liaocheng High-tech Zone University Science and Technology Park. Professor Tursunbayev Zaporotot, President of Osh Technological University of the Kyrgyz Republic and corresponding academician of the Kyrgyz Academy of Engineering, and Academician Smaylor Erta of the Kyrgyz Academy of Engineering and the Russian Academy of Natural Sciences, among other experts and scholars from "Belt and Road" countries, participated in the event. Liaocheng Deputy Mayor Wang Gang and Zhang Ya, Party Secretary and Director of the Management Committee of the High-tech Zone, attended the event and delivered speeches.

This training event not only provided a valuable learning opportunity for company managers and key personnel, but also built a platform for communication and sharing. During the training, everyone actively interacted and discussed enthusiastically, exploring effective ways to improve management capabilities together. Through this training, everyone has gained rich knowledge and skills, but more importantly, it has inspired confidence and motivation for the future.

How to use a five-axis machining center efficiently? Today, let's learn a few practical steps!

When using a five-axis machining center, the equipment must first be adjusted to ensure that the workpiece and fixture dimensions precisely match, and that the zero points of each axis are accurately adjusted.

Why do composite materials require 5-axis CNC machining?

Composite materials are widely used in various fields such as aerospace, automotive, construction, energy, energy storage, infrastructure, marine, pipelines and tanks, sports and entertainment, and transportation due to their light weight, high fatigue resistance, and strong fracture resistance. Among them, aerospace and automotive industries are the largest application markets for composite materials. Five-axis CNC plays an important role in the processing of composite materials. Why do composite materials need to be processed using five-axis CNC?

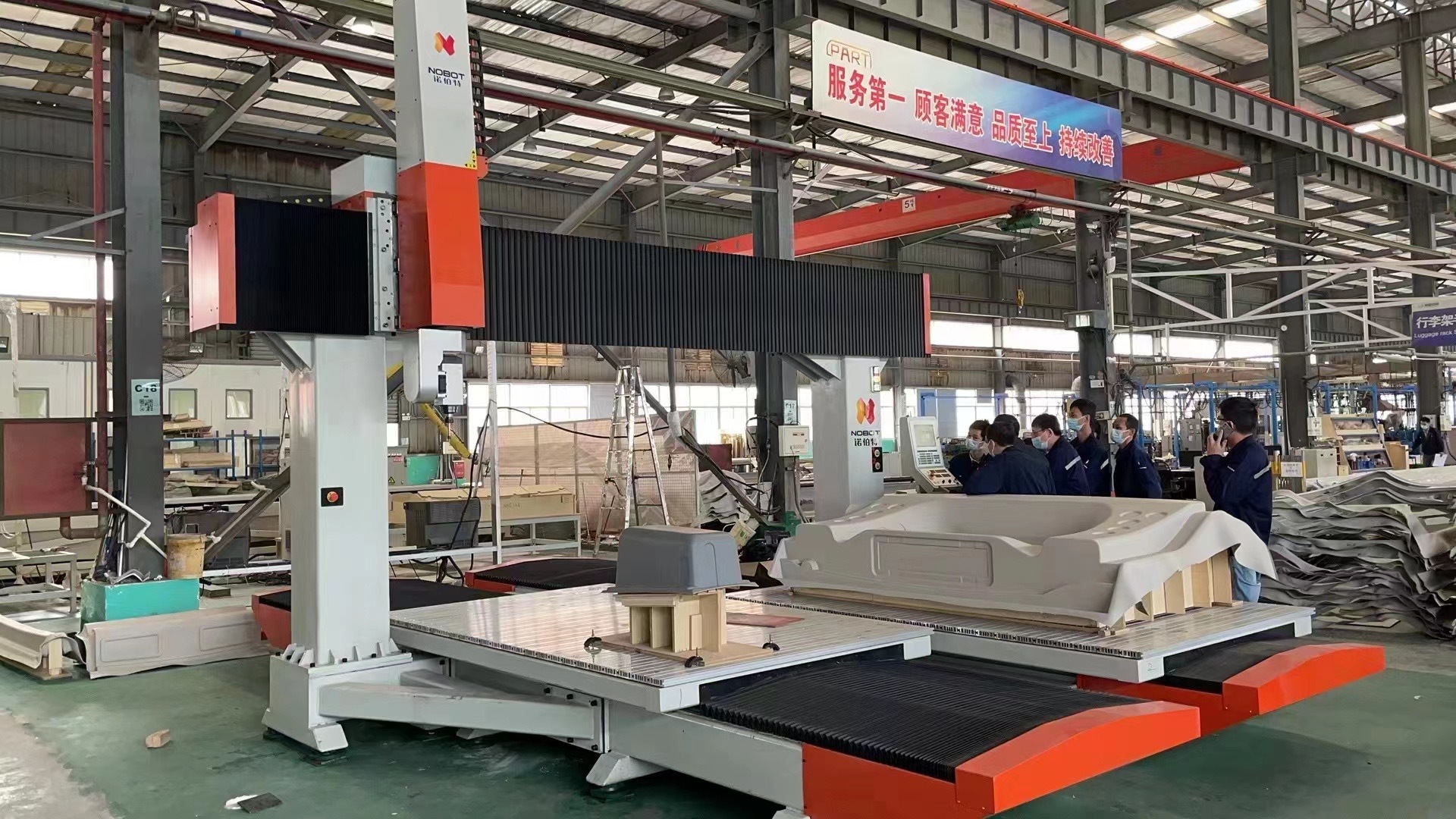

Dual-station five-axis machines offer several significant advantages. First, while one station is being machined, the other can be used for material loading and unloading, ensuring continuous, non-stop machining and significantly improving production efficiency. Second, the dual-station design makes operation more convenient and reduces waiting time. However, dual-station five-axis machines typically cost more than single-station machines and may require more operating and maintenance space.